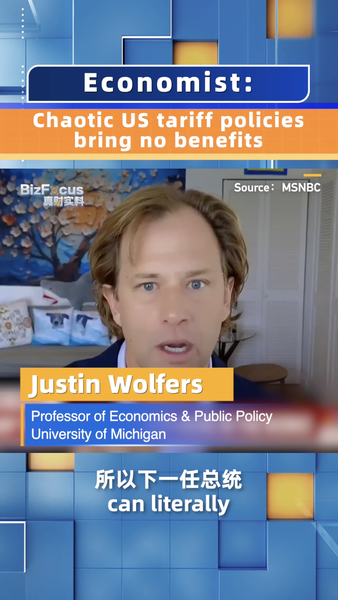

Ever noticed your smartphone upgrade feels pricier? Or that a bag of rice costs a bit more at the market? 🤔 That's partly the fallout from chaotic US tariff policies, warns economist Justin Wolfers from the University of Michigan. He told MSNBC that these import taxes, slapped on with no green light from Congress, are hiking costs across the board—and job returns are nowhere to be seen.

Tariffs are basically taxes on imported goods. While they might sound like a power move—protecting local factories and bringing jobs back—Wolfers points out they're not approved by Congress and they end up hitting wallets instead of boosting manufacturing. Think: you end up paying extra for that new gadget or trendy sneakers, but factories aren’t humming back to life.

In South and Southeast Asia, where electronics, auto parts, and even raw materials often flow in from the US, higher US import taxes can create a ripple effect. Companies adjust supply chains, costs trickle down to consumers, and businesses scramble to stay competitive. Yet local jobs? Still slipping away to automation or cheaper production hubs.

This isn’t just US news—it’s global. From tech-addicted city dwellers in Mumbai hunting for the next big gadget, to startup founders in Jakarta hustling for affordable components, everyone feels the pinch. Instead of a clear strategy, the back-and-forth slam on imports adds uncertainty to trade deals, investments, and everyday budgets.

So what’s next? Experts suggest a more stable trade plan that actually involves Congress, industry feedback, and clear pathways to support small factories. That means balancing import rules with incentives for local innovation—imagine startups in Bengaluru or Ho Chi Minh City getting tax breaks to scale manufacturing, rather than depending on unpredictable tariffs.

What do you think—are tariffs the right tool for reviving jobs, or just a costly detour? Share your thoughts! 💬

Reference(s):

cgtn.com