Hey fam, big news in finance: foreign investors are pouring cash into the Chinese mainland’s stock market, and it’s making waves across Asia! 🌏💸

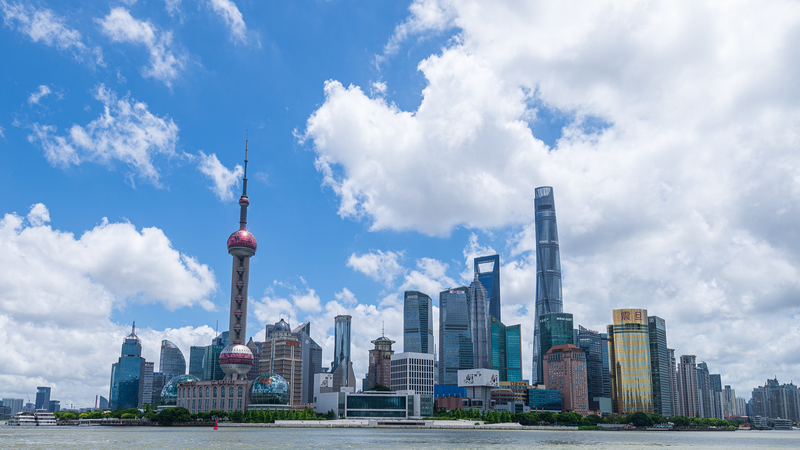

On Tuesday, the Shanghai Composite Index hit 3,746.67 points—its highest level in almost a decade. That index is basically a scorecard for all stocks listed on the Shanghai Exchange, so this spike shows real confidence. 📈

In their H1 2025 reports released Monday, qualified foreign institutional investors (QFIIs)—fancy term for major overseas funds—claimed spots among the top-10 shareholders in over 70 companies on the Chinese mainland’s A-share market. Combined, they’re holding about 6.8 billion yuan (roughly $950 million). 💰

What are they buying? Sectors like automobiles 🚗 (hello, EV lovers!), pharmaceuticals & biotech 💊 (pandemic lessons really drove interest), food & beverages 🍔 (snack time!), and hardware equipment ⚙️ (your next smart gadget). It’s a broad mix signaling trust in both innovation and daily essentials.

For us in South and Southeast Asia, this matters. Strong flows into the Chinese mainland market can influence regional stocks, spark more cross-border fintech tie-ups, and even inspire local startups to think bigger. Whether you’re trading via mobile apps or following market news over chai or kopi, it’s time to keep an eye on these trends! ☕📲

TL;DR: Foreign investors are bullish on the Chinese mainland’s stocks, from cars to healthcare. With Shanghai Composite at a decade-high, the region’s markets are buzzing. Stay tuned! 🔥

Reference(s):

cgtn.com