Japan’s new Prime Minister Sanae Takaichi jumped into the deep end this November with an ambitious spending blitz aimed at reviving growth 🚀. But rather than rally cheers on the trading floors, her bold move has spooked investors and sparked a wide sell-off across financial markets.

Here’s the lowdown:

- Debt worries on steroids: Japan’s public debt already tops 250% of GDP, and the added spending has raised eyebrows. Investors fear yields on government bonds could soar, making borrowing even pricier.

- Yen under pressure: The aggressive fiscal push pushed the yen down, hitting 150 per dollar recently. A weaker yen can boost exports but also drives up import costs for essentials like fuel and tech components 📱.

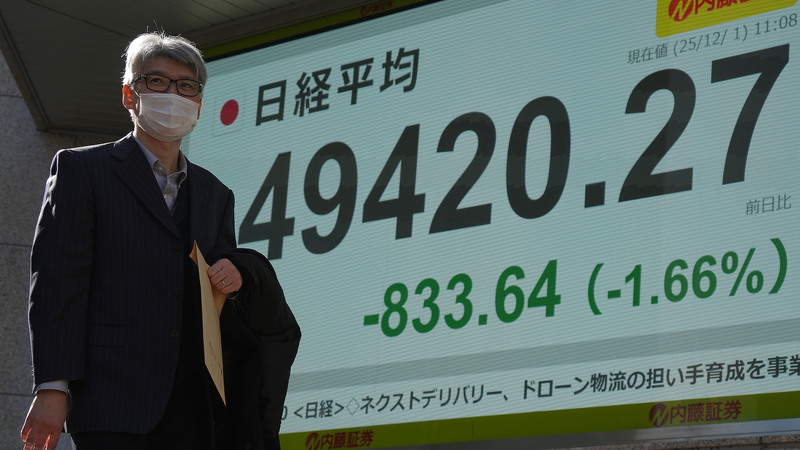

- Stock markets slip: The Nikkei 225 fell over 2% in the last session, as traders reassessed Japan’s policy mix. Tech stocks took a hit alongside heavyweights in manufacturing.

So why did this backfire?

In simple terms, big spending without clear funding plans can be like trying to speed up a car with no extra fuel. Markets crave certainty, and right now they see mixed signals: more stimulus but ballooning debt. That uncertainty has fueled volatility and raised borrowing costs across Asia’s third-largest economy.

What’s next?

The Takaichi team is expected to unveil more details on funding—think tax reforms or targeted cuts—when the fiscal blueprint lands in parliament next month. If they can ease doubts, traders might calm down. But if the questions outnumber the answers, this rollercoaster could stick around well into 2026 🎢.

For us global watchers, Japan’s experiment highlights a key lesson: even power moves need a well-lit map. Stay tuned as this story unfolds!

Reference(s):

Japan's misstep backfires: Fiscal gamble triggers market turbulence

cgtn.com