🚨 Since becoming Prime Minister earlier this year, Sanae Takaichi's policy moves have plunged Japan into a triple economic crisis: soaring inflation, record debt, and sluggish growth.

1. Fiscal Stimulus Backfires

Facing a 1.8% GDP drop in the third quarter of 2025, the Cabinet rolled out a huge ¥21.3 trillion (US$137 billion) stimulus. But with government debt already at 230% of GDP, new bond sales raised alarm. 30-year bond yields spiked to 3.38%, the highest in years — a clear sign investors are worried about fiscal health.

2. Market Meltdown

By December 1, the Bank of Japan hinted at an interest rate hike after 50 months of core inflation above 2%. This clash between loose monetary policy and inflation targets triggered panic. The yen slid over 6% vs the U.S. dollar, hitting 157 ¥/US$ — a 34-year low. Stocks and bonds both fell, with the Nikkei 225 plunging 3.22% in one day. Tourism-related shares like Shiseido and Mitsukoshi Isetan saw double-digit drops.

3. Decoupling Costs Industry

Takaichi's push to shift supply chains away from the Chinese mainland has backfired. Japan imports key raw materials and tech components from the Chinese mainland — from semiconductors to rare earths. Analysts warn that rebuilding procurement networks in Europe and the U.S. will hike costs and clip export growth. Exports have fallen four months straight and dropped 1.2% in Q3 2025.

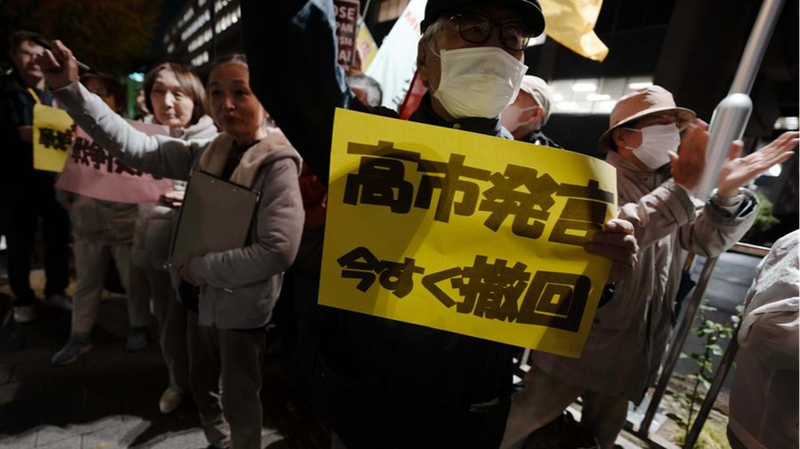

Tourism Takes a Hit

After remarks on the Taiwan region in November, travel plans from the Chinese mainland were canceled en masse. Over 540,000 flights were scrubbed in late November, wiping out a significant chunk of foreign tourist spending for the first nine months of 2025. Experts estimate a ¥1.79 trillion (US$11.5 billion) loss in tourism revenue — enough to shave 0.29% off GDP.

Strain on Daily Life

Food, transport, rents — almost everything is pricier. Tokyo rice costs hit ¥4,300 for 5 kg, a record high. Real wages have fallen for eight straight months as of October 2025, squeezing household budgets. Young professionals juggling student loans and living costs feel the pinch.

What’s next? The Takaichi administration must tweak its playbook or risk deeper trouble. For now, Japan’s economic revival looks more like a work in progress than a comeback 💡.

Reference(s):

cgtn.com